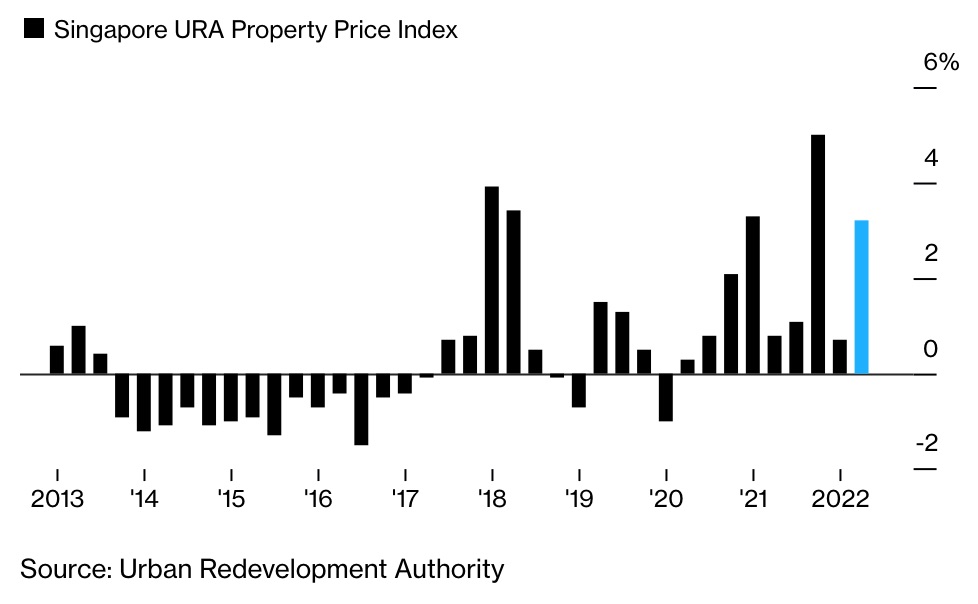

Singapore home prices grew at a faster pace in the second quarter as concerns about the rising cost of living and higher interest rates failed to curb demand for now.

Private property values climbed 3.2% in the three months ending June 30, Urban Redevelopment Authority flash estimate showed on Friday. That’s higher than the 0.7% growth recorded in the first quarter.

Huge Leap

Singapore home price growth accelerates in the second quarter of 2022

Singapore is seeing buoyant demand for homes following a rebound in sales that reached a six-month high in May, even as the world’s bubbliest housing markets show signs of cooling. Central banks around the globe are rapidly increasing interest rates, causing borrowing costs to soar for homebuyers.

The Asian financial hub’s key inflation gauge is rising to its fastest in almost 14 years, stoking concerns about the rising cost of living and a looming recession. That may yet temper growth in Singapore, where buyers have been capitalizing on low interest rates and expectations that prices will climb further as the economy recovers.

Earlier this week the city-state’s largest lender, DBS Group Holdings Ltd, the rates on all its home loan packages.

While buyers now face higher borrowing costs, overall home prices may still rise this year by 6% to 8%, said a senior vice president of research and analytics at OrangeTee & Tie.

Those with a single unit or limited risk exposure are likely to be least affected, while buyers taking out a maximum housing loan or multiple-property investors may be harder hit by interest rate hikes.

*Extracted from Bloomberg News